Investor Relationships (CRM)

From Transactions to Trusted Relationships

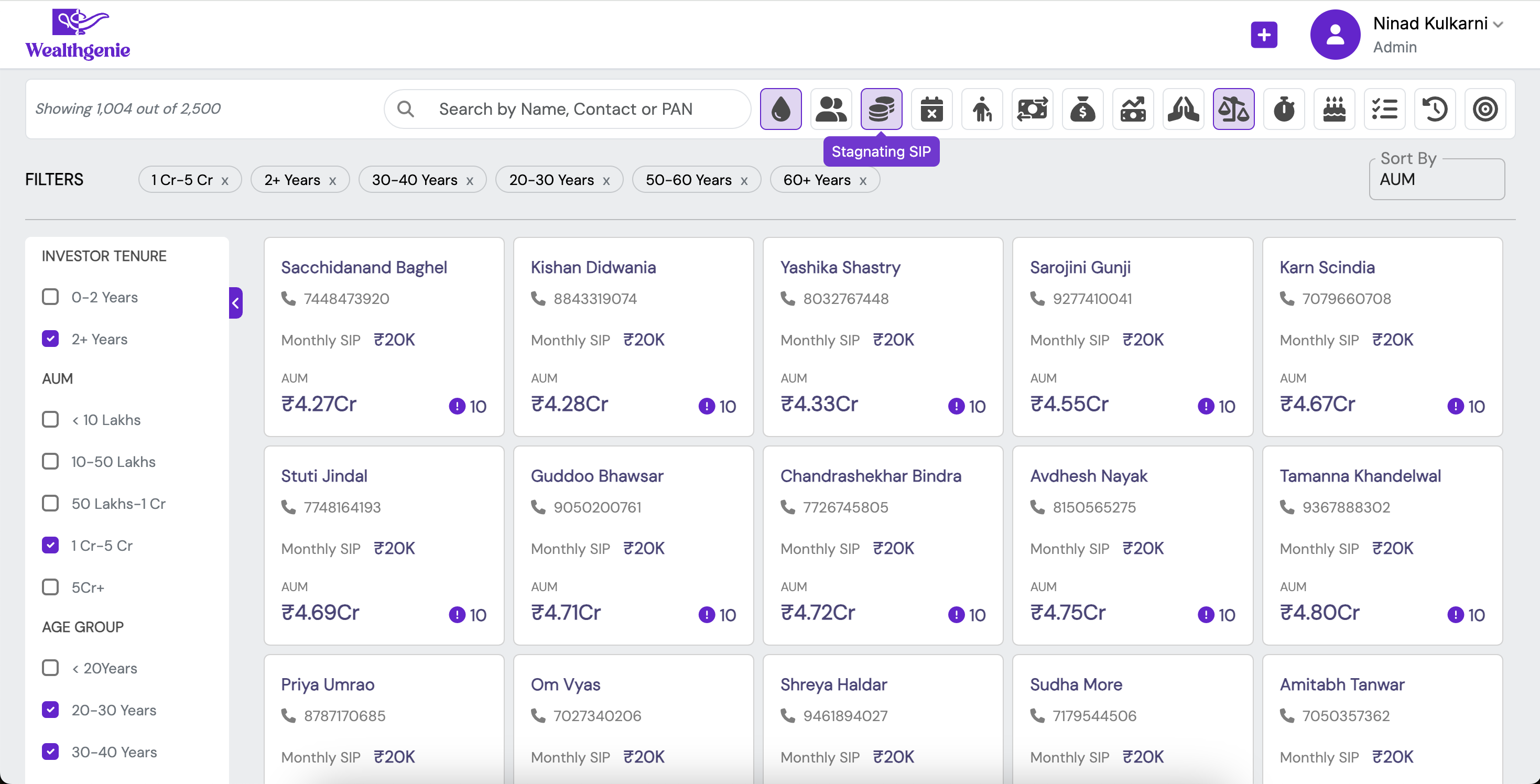

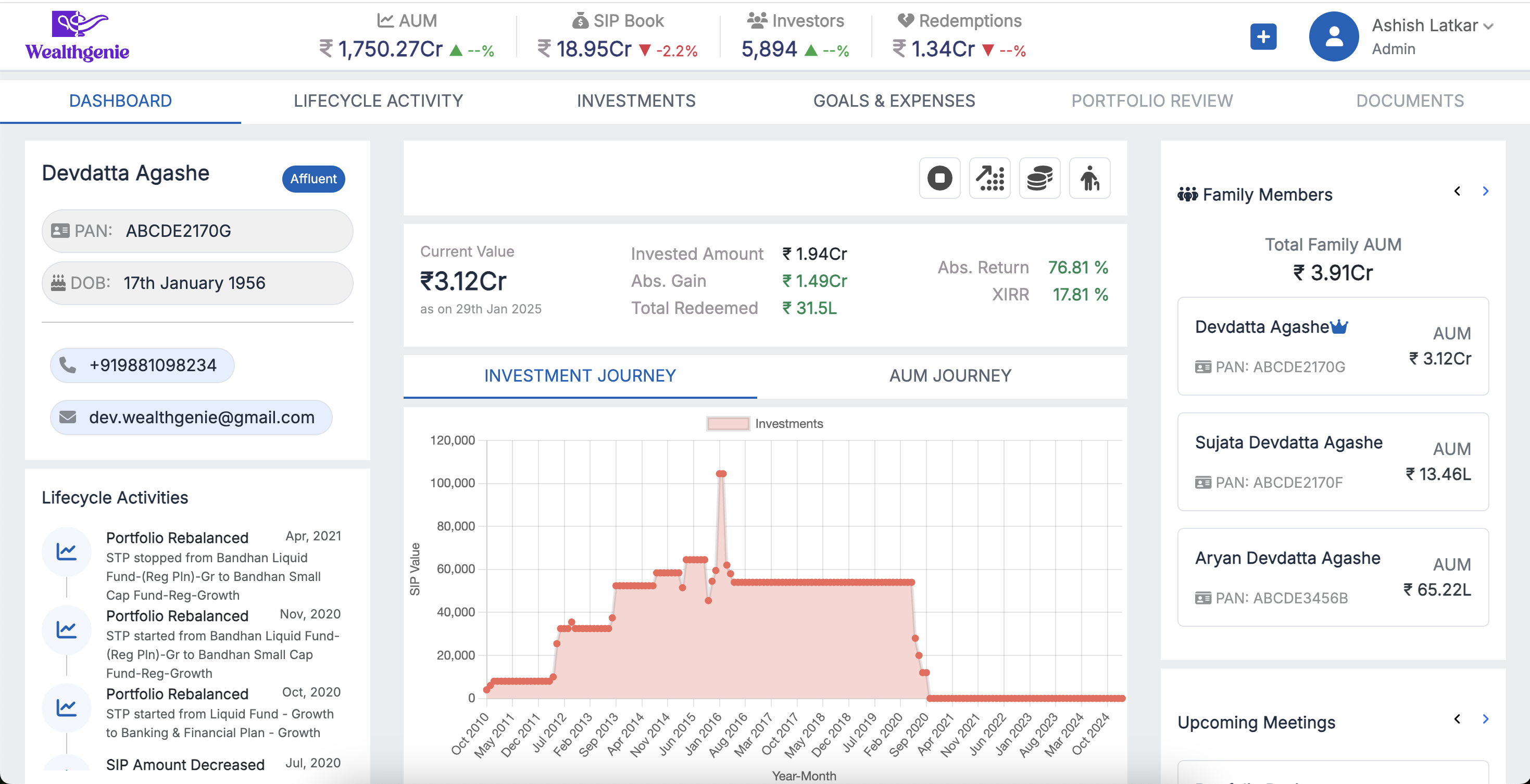

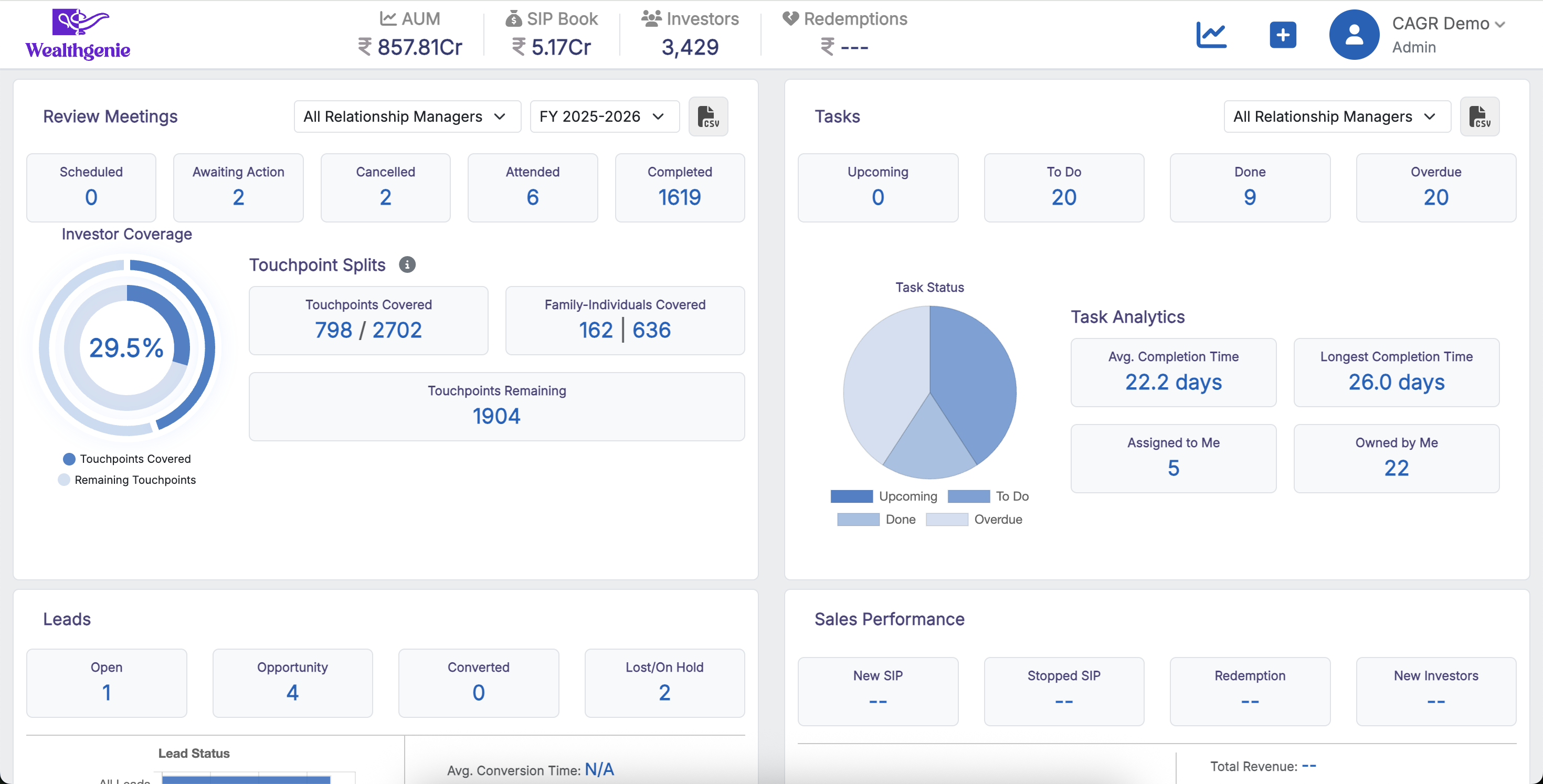

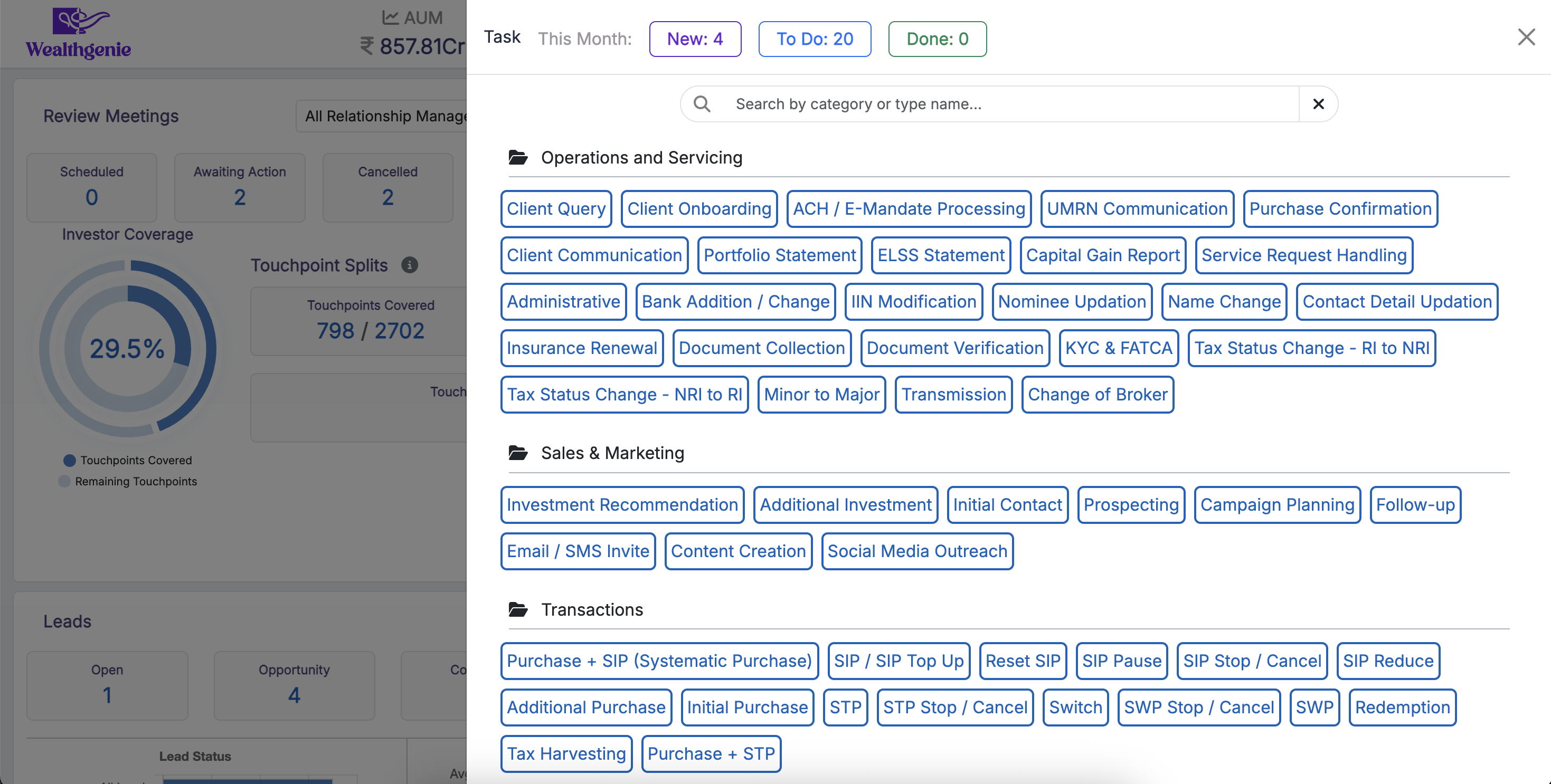

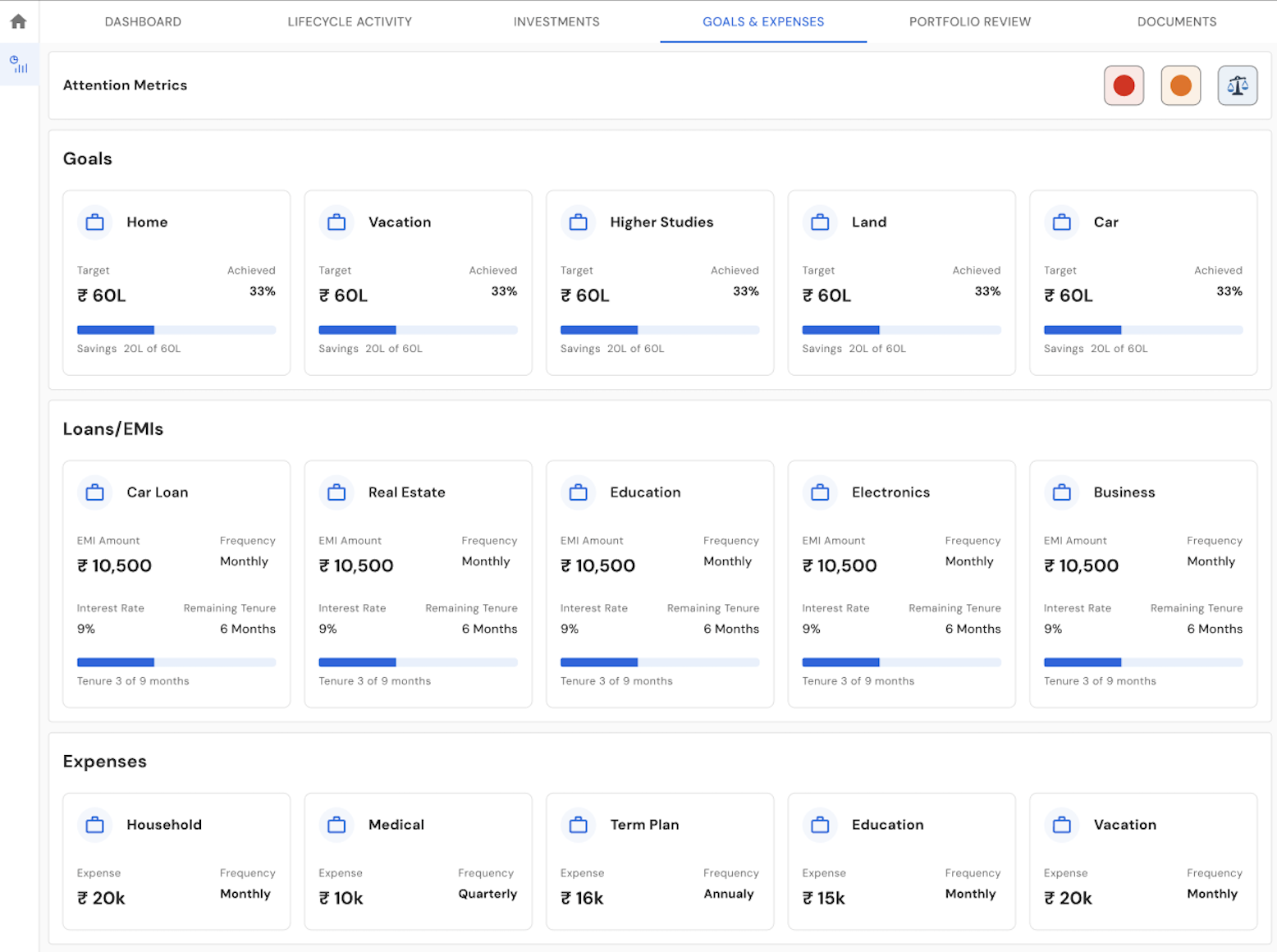

Tells you which investor to meet, when, and why—with meeting notes and touchpoint insights at your fingertips. Built-in analytics track coverage vs. time, ensuring no opportunity is missed while monitoring RM performance and organizational metrics.